Introducing RWAs to 10M+ Users

RWALayer is the easiest way to access and trade real world assets from real estate to commodities, all in one app. Every trade earns you rewards.

{01/06} Our Ecosystem

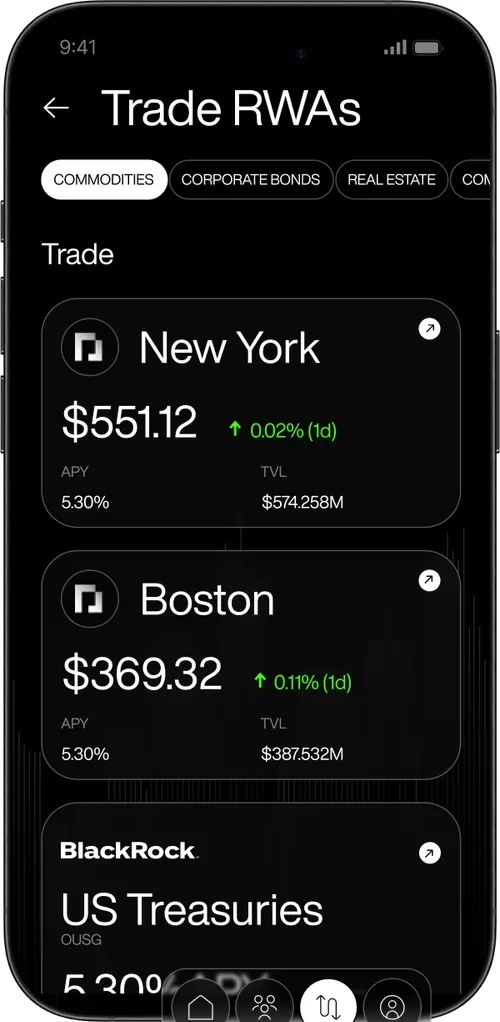

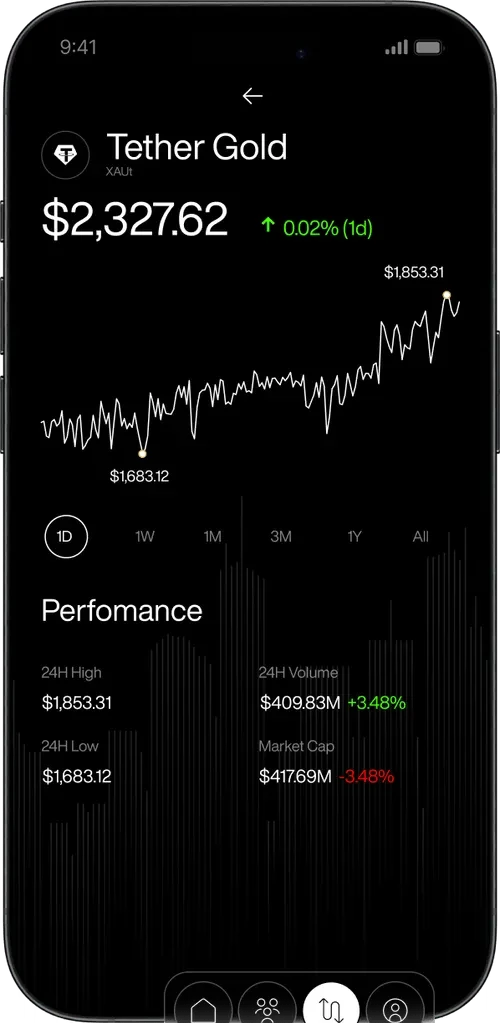

Scroll to see more ↓RWAs All in One Place

AI Integrations

Scroll to see more ↓Ecosystem Integrations

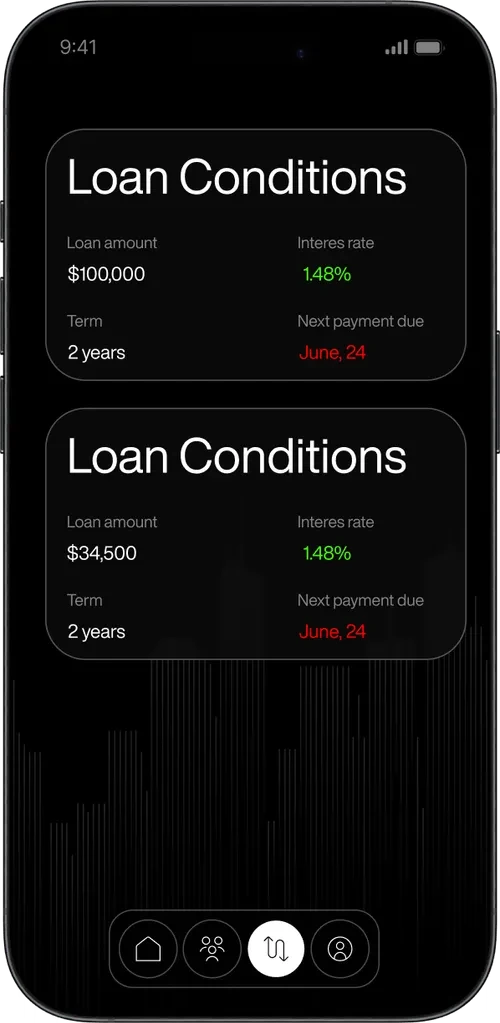

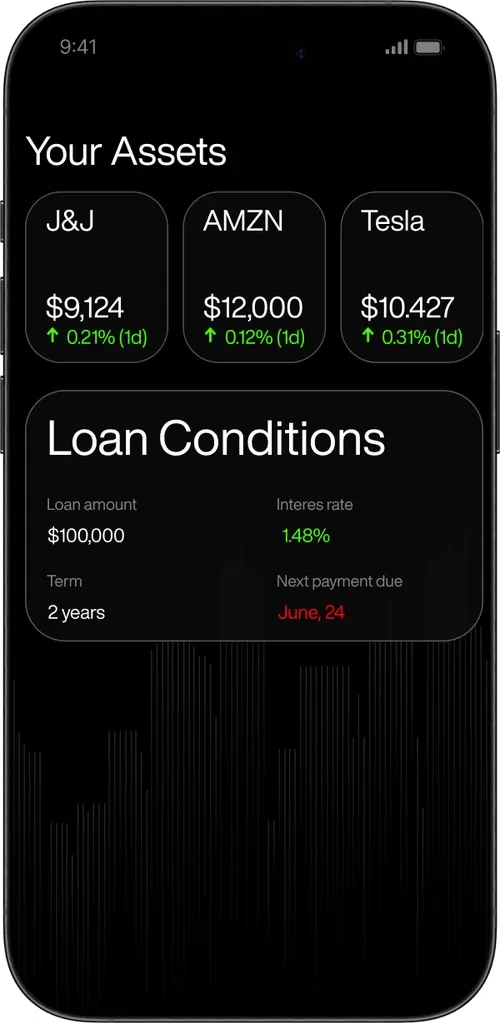

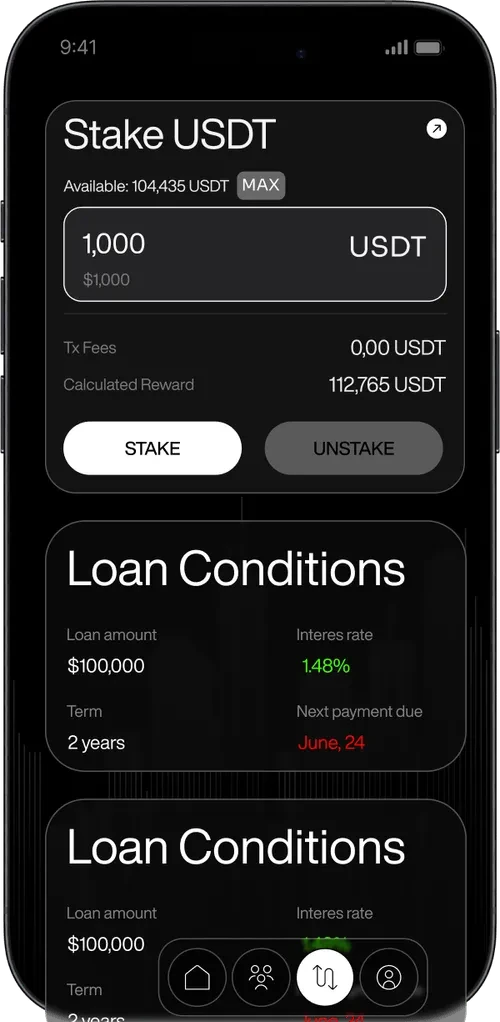

{02/06} Our app

Scroll to see more ↓Initialize Web3 const web3 = new Web3(new Web3.providers.HttpProvider(process.env.INFURA_URL)); // Load smart contract ABI and address const contractABI = require('./ContractABI.json'); // Assuming ABI is in a JSON file const contractAddress = process.env.CONTRACT_ADDRESS; // Create contract instance const contract = new web3.eth.Contract(contractABI, contractAddress); // Endpoint to stake USDC app.post('/stake-usdc', async (req, res) => { const { userAddress, amount } = req.body; if (!web3.utils.isAddress(userAddress)) { return res.status(400).send('Invalid user address'); } if (!amount || amount <= 0) { return res.status(400).send('Invalid amount'); } try { const tx = { from: userAddress, to: contractAddress, gas: 2000000, data: contract.methods.stakeUSDC(web3.utils.toWei(amount, 'mwei')).encodeABI() // USDC uses 6 decimals }; // Sign and send the transaction const signedTx = await web3.eth.accounts.signTransaction(tx, process.env.PRIVATE_KEY); const receipt = await web3.eth.sendSignedTransaction(signedTx.rawTransaction); res.status(200).send({ message: 'USDC staked successfully', transactionHash: receipt.transactionHash }); } catch (error) { console.error(error); res.status(500).send('Error staking USDC'); } }); app.listen(port, () => { console.log(`Server running on port ${port}`); });

Initialize Web3 const web3 = new Web3(new Web3.providers.HttpProvider(process.env.INFURA_URL)); // Load smart contract ABI and address const contractABI = require('./ContractABI.json'); // Assuming ABI is in a JSON file const contractAddress = process.env.CONTRACT_ADDRESS; // Create contract instance const contract = new web3.eth.Contract(contractABI, contractAddress); // Endpoint to stake USDC app.post('/stake-usdc', async (req, res) => { const { userAddress, amount } = req.body; if (!web3.utils.isAddress(userAddress)) { return res.status(400).send('Invalid user address'); } if (!amount || amount <= 0) { return res.status(400).send('Invalid amount'); } try { const tx = { from: userAddress, to: contractAddress, gas: 2000000, data: contract.methods.stakeUSDC(web3.utils.toWei(amount, 'mwei')).encodeABI() // USDC uses 6 decimals }; // Sign and send the transaction const signedTx = await web3.eth.accounts.signTransaction(tx, process.env.PRIVATE_KEY); const receipt = await web3.eth.sendSignedTransaction(signedTx.rawTransaction); res.status(200).send({ message: 'USDC staked successfully', transactionHash: receipt.transactionHash }); } catch (error) { console.error(error); res.status(500).send('Error staking USDC'); } }); app.listen(port, () => { console.log(`Server running on port ${port}`); });

The L2 RWA Chain with Built in Yield

As users deposit TVL to the L2, it automatically deploys into the treasury. Alongside this, as users engage in defi activities on the protocol, they earn yield from treasury exposure.

The protocol is built similar to a chain whereby all stablecoins bridged earn yield, alongside the yield users generate by engaging in native DeFi farming.

US Treasury Bills

Global Real Estate Markets

Commodity Exposure

Corporate Bond Funds

{03/06} Key features

Scroll to see more ↓Key Features

{01/03}

Institutional-Grade Access

Get exposure to real estate, commodities, bonds, and alternative assets all in one app, without the red tape.

{02/03}

Transparent & Secure

Every asset is tokenized with full transparency, so you always know exactly what you own and how it performs.

{03/03}

Rewards on Every Trade

Unlike traditional brokers, RWALayer rewards you in RWALayer's Stablecoin back with every trade made in the app.

Bridge

{04/06} Market correlation

Scroll to see more ↓How RWALayer Relates to Different Markets

The decoupling of legacy markets and web3 asset markets, together with the rising on-chain deployable liquidity creates a substantial addressable opportunity for RWALayer

{05/06} Bridge your assets

Scroll to see more ↓

Activate the Airdrop in RWALayer App

Unique Wallets Connected for Airdrop

53

{06/06} Our story

Scroll to see more ↓Subscribe

Scroll to see more ↓Enter your email address to receive airdrop news first